I recently read a great post by our friend Simon Carless over at GameDiscoverCo about Steam prices lowering. If you haven’t already, it’s well worth subscribing to Simon’s newsletter. With several interesting data points, it did get me thinking about middle ground pricing from a marketing perspective. Steam pricing is starting to behave less like a neat ladder and more like a barbell: big-brand premium releases at one end, and a swelling mass of $5–$15 “cheap-but-fun” hits at the other. The uncomfortable place to stand is the middle—especially around $20, where you’re competing with both new releases and a decade of premium titles that still feel modern.

That’s why the most interesting “prices are dropping” story on Steam isn’t “everyone’s racing to the bottom.” but instead it’s actually, it’s who wins units, and what that does to marketing.

The key signal: the median is dropping, not the average

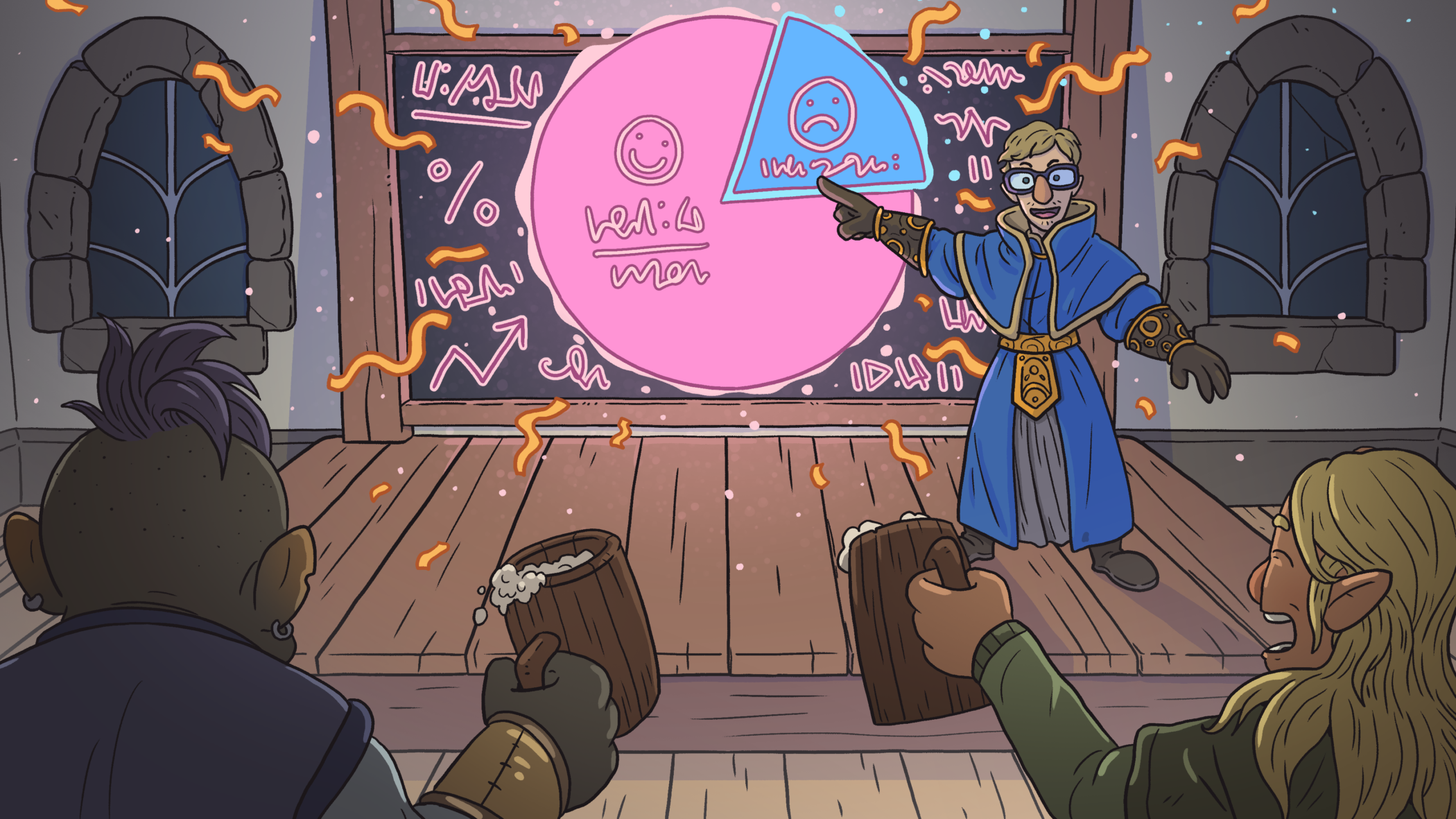

GameDiscoverCo’s analysis of the Top 50 new, non-F2P Steam releases each month (ranked by 30-day copies sold) shows the difference clearly: the average price from Feb 2023 to Oct 2025 is basically flat (down ~2%), but the median fell from $19.50 to $15.64 (~20% drop)—suggesting that, by unit volume, cheaper games are taking a larger share of what breaks out.

GamesRadar’s summary of that research puts the market pressure in plain terms: charging above $25 is getting trickier, because players benchmark value against $10–$15 indies and heavily discounted older games. So yes—there’s credible evidence that successful new releases, in the unit-weighted “typical case,” are trending cheaper. But the nuance matters: this doesn’t mean higher priced games can’t win. It means the market’s center of gravity is moving. But Why? Well, there are multiple variables at any given time, but consumer behaviour tends to support that:

1. Players have a massive backlog of games to choose from, including heavily discounted premium titles on sale.

2. Economic hardships are leading to more price-conscious consumers, which is why refunds are up, and wishlist conversion as a whole remains lower.

3. Players are picking up more games on sale and spending more time in older games 2-4 years old. Steam’s own data supports this, with only 14% of playtime spent by all Steam users in new releases (games released in 2025)

4. Big IPs are leaning into more accessible pricing: The new Hollow Knight sits at the $20 mark, and the massively successful arc raiders at $40, which easily could have been a $60 title. Leading to more competition at more accessible price points.

Why $20 is a knife fight: you’re competing with ‘already legendary‘

When you price a new game at ~$19.99, you’re not only being compared to other new games. You’re being compared to evergreen classics that have huge reputations, massive review counts, years of patching, and endless community content.

Take the original Hollow Knight as a simple illustration of the “anchor problem”: its US Steam price is $14.99 (and it’s even lower in some regions). Whether a player is rational about budgets or not, that number becomes an instant mental benchmark: “If that level of craft is ~$15, why is this new unknown $20?”

This is where the point about high-quality feel matters, even if budgets aren’t public, a handful of iconic indies (like Hollow Knight) function like AAA-quality anchors in the customer’s perception. They force your marketing to answer a brutal question immediately:

“What do I get here that I can’t get from a proven masterpiece?”

That’s not a pricing problem. It’s a positioning and promise problem.

The attention economy makes value louder than ever

Two other market realities amplify price pressure:

1) New games are fighting for a small slice of attention.

Newzoo reports that only 12% of 2024’s total playtime came from new games—most hours were spent on established or older titles. When players are spending most of their time in “forever” games, the purchase decision becomes more conservative and comparative.

Newzoo also notes that, on Steam, the share of players engaging with three or fewer games annually rose from 22% (2021) to 34% (2024). Fewer “slots” in the player’s year means each purchase faces higher scrutiny: Is this worth one of my slots?

2) Discoverability is vicious.

PC Gamer (citing SteamDB) notes that over 19,000 games launched on Steam in 2025, and almost half had fewer than 10 user reviews. In a feed-driven store, your price becomes part of your conversion funnel. If you win a click but lose on the “hmm, seems expensive for what it is” moment, you don’t just lose a sale—you might lose your only chance at algorithmic lift.

Cheaper doesn’t have to mean cheap: pricing as creative direction

Here’s the marketing opportunity: price can be a promise, not just a number. In a world where players are comparing you to $10–$15 “ton of fun and playtime” titles and to discounted back-catalog deals, a sharper price can function like a call-to-action—but only if you protect perceived quality. I talk a lot to studios about signalling, about how your message and market your game needs to signal confidence in the end product.

Cheap pricing can signal one of three “good things” (if you message it right)

A) “Lower friction, stand out.”

A lower price reduces “decision tax.” That matters when players are selective and time-poor. But it can be more than that, it can actually help shape perception. For example, pricing at $17.99 still feels weighty and premium but allows a game to stand out versus the competition heavy $19.99 and will draw less comparisons to the heavy hitters of the price point.

B) “Designed for replayability.”

Many of the breakout indie titles are replayable formats (Survivors-like, roguelite, co-op party loops). Pricing communicates: This is a toy box, not a one-and-done.

C) “Accessibility”

All games benefit from more players, especially multiplayer focused ones, but a lower price can become a distribution and marketing strategy: more buyers → more clips → more creator adoption → more Steam visibility. This is how titles such as Vampire Survivors create self-propelling marketing in an overcrowded store.

Marketing plays that turn lower prices into higher perceived quality

1) Don’t highlight price, Show value.

Your copy and visuals should emphasize intentionality:

- Your Hook

- Unique selling points

- Performance, ambience, and vibes.

This frames the price as editorial confidence, not cost-cutting.

2) Use edition architecture to anchor quality

If you choose an aggressive base price, protect your premium perception with a tiered structure:

- Base game (accessible)

- Deluxe / Supporter edition (OST, artbook, cosmetic pack, dev commentary)

- Post-launch “Complete the Set” bundles.

Even if most buyers choose the base, the premium tier acts as a quality anchor in the same way that evergreen classics anchor value.

3) Time your discounting like a campaign beat (not a habit)

Budget sensitive players are paying less for older games due to constant catalog sales and deep discounts. That means you should treat discounts as moments with messaging (launch week, big update, 1.0, seasonal event), rather than background noise that trains people to wait.

4) Make “value proof” visible fast: demo + reviews + clarity

In a year where a huge number of releases struggle to earn even a handful of reviews, your proof signals carry extra weight.If you’re pricing lower as a hook, you still need the conversion scaffolding:

- Demo that hits the core loop quickly

- Trailer that shows the best 10 seconds early

- Review snippets as soon as you have them

- Clear “what you do” store tags and one-sentence pitch

Lower price gets the click; proof closes the sale.

5) “$20 bracket” strategy: differentiate on why you exist

If you really want to live around $19.99–$24.99, assume you’re being compared to evergreen classics and plan accordingly:

- Own a sharper niche (“the co-op heist roguelite built for three friends”)

- Offer a stronger novelty hook (mechanic, fantasy, or format)

Build a content narrative (engage community with dev diaries, Discord, socials)

In reality, the hardest part isn’t the price. It’s giving players a reason to choose you over a known quantity priced similarly (or less). The value proposition, the perception of the game, the emotional connection to the materials, that is what matters. The price is a part that can help get over the final conversion hurdle but without strong emotionally led marketing where players are hooked into the game, price, no matter how low will still be a barrier.

The bottom line

Steam isn’t simply becoming a bargain bin. The more accurate story is:

- Median “best-selling new release” prices are trending down, meaning cheaper titles are taking more unit share at the top of the charts.

- Players have limited attention for new games, and a growing share engage with only a few titles per year so the hook of the game matters more than ever.

- The store is crowded, so pricing can be a practical way to improve conversion—if (and only if) you defend quality perception with strong positioning and proof.

- Lower pricing is not a substitute for good marketing, It‘s a part of the whole, not a replacement.

In 2026, cheaper can be a legitimate marketing opportunity: not a retreat, but a deliberate bet on lower friction, faster adoption, and a clearer promise.